More Articles

If you had a successful night at the slots or poker tables, you're going to have to share some of the lucky proceeds with Uncle Sam. The Internal Revenue Service generally requires that you report your gambling winnings and losses separately when you file your taxes rather than combining the two amounts.

Record Keeping

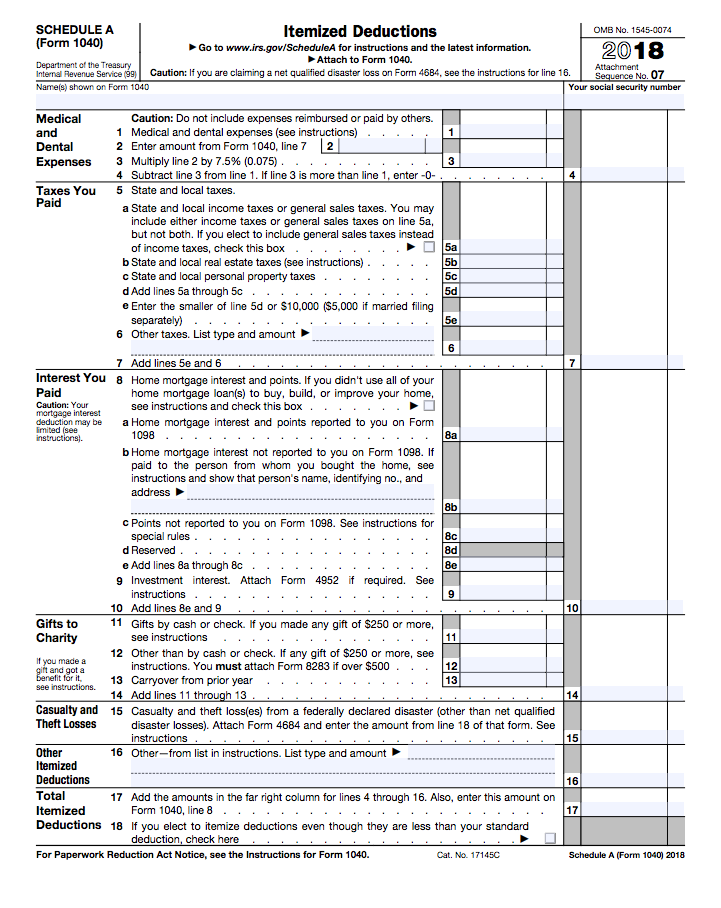

While the IRS does not have a gambling losses tax, it does allow for you to deduct gambling losses on your tax return in the form of a miscellaneous deduction. To deduct your losses from gambling, you will need to: Claim your gambling losses on Form 1040, Schedule A as Other Miscellaneous Deduction (line 28) that is not subject to the 2% limit. If you're a casual gambler, report your winnings on the 'Other Income' line of your Form 1040, U. Individual Income Tax Return. You may deduct your gambling losses on Schedule A, Itemized Deductions. The deduction is limited to the amount of your winnings. You must report your winnings as income and claim your allowable losses separately.

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

- There is one golden rule to keep in mind when deducting gambling losses on your tax return. You can't, unfortunately, deduct losses that total more than your winnings. So, if you made $10,000 on gambling last year but lost $12,000, you can only deduct $10,000 in losses (nothing more). This can be a bit of a bummer, but don't worry.

- You may deduct gambling losses on your Minnesota income tax return if you choose to claim Minnesota itemized deductions. You cannot deduct more in gambling losses than you report in gambling winnings on your federal income tax return. Also, you must be able to prove the amount of your losses with the records noted above.

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

- tax forms image by Chad McDermott from Fotolia.com

Read More:

Claiming Gambling Losses On Tax Return

© TheStreet Can You Claim Gambling Losses on Your Taxes?Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return. The deduction is only available if you itemize your deductions. If you claim the standard deduction, then you can't reduce your tax by your gambling losses.

Don't worry about knowing tax rules, with TurboTax Live, you can connect with a real CPA or EA online from the comfort of your own home for unlimited tax advice and a line-by-line review, backed by a 100% accurate expert approved guarantee.

Keeping track of your winnings and losses

The IRS requires you to keep a log of your winnings and losses as a prerequisite to deducting losses from your winnings. This includes:

Popular Searches

- lotteries

- raffles

- horse and dog races

- casino games

- poker games

- and sports betting

Your records must include:

- the date and type of gambling you engage in

- the name and address of the places where you gamble

- the people you gambled with

- and the amount you win and lose

Other documentation to prove your losses can include:

Claiming Gambling Losses On Tax Return

- Form 5754

- wagering tickets

- canceled checks or credit records

- and receipts from the gambling facility

Limitations on loss deductions

The amount of gambling losses you can deduct can never exceed the winnings you report as income. For example, if you have $5,000 in winnings but $8,000 in losses, your deduction is limited to $5,000. You could not write off the remaining $3,000, or carry it forward to future years.

Claiming Gambling Losses On Tax Return Due Date

Reporting gambling losses

To report your gambling losses, you must itemize your income tax deductions on Schedule A. You would typically itemize deductions if your gambling losses plus all other itemized expenses are greater than the standard deduction for your filing status. If you claim the standard deduction,

Del Lago Resort & Casino, Waterloo: Hours, Address, del Lago Resort & Casino Reviews: 3.5/5. 1133 State Route 414 Exit 41 New York State Thruway, Waterloo, NY. Seize The Action. Take a break from the ordinary and experience nonstop action at del Lago Resort & Casino. Our modern gaming floor features over 1,700 Slots, 66 Table Games including 14 Poker Tables, and our all-new DraftKings Sportsbook with 23 betting kiosks available 24/7 and over 1,000 square feet of cutting-edge LED video screens. Casino resort waterloo new york in.

- You are still obligated to report and pay tax on all winnings you earn during the year.

- You will not be able to deduct any of your losses.

Only gambling losses

While the IRS does not have a gambling losses tax, it does allow for you to deduct gambling losses on your tax return in the form of a miscellaneous deduction. To deduct your losses from gambling, you will need to: Claim your gambling losses on Form 1040, Schedule A as Other Miscellaneous Deduction (line 28) that is not subject to the 2% limit. If you're a casual gambler, report your winnings on the 'Other Income' line of your Form 1040, U. Individual Income Tax Return. You may deduct your gambling losses on Schedule A, Itemized Deductions. The deduction is limited to the amount of your winnings. You must report your winnings as income and claim your allowable losses separately.

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

- There is one golden rule to keep in mind when deducting gambling losses on your tax return. You can't, unfortunately, deduct losses that total more than your winnings. So, if you made $10,000 on gambling last year but lost $12,000, you can only deduct $10,000 in losses (nothing more). This can be a bit of a bummer, but don't worry.

- You may deduct gambling losses on your Minnesota income tax return if you choose to claim Minnesota itemized deductions. You cannot deduct more in gambling losses than you report in gambling winnings on your federal income tax return. Also, you must be able to prove the amount of your losses with the records noted above.

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

- tax forms image by Chad McDermott from Fotolia.com

Read More:

Claiming Gambling Losses On Tax Return

© TheStreet Can You Claim Gambling Losses on Your Taxes?Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return. The deduction is only available if you itemize your deductions. If you claim the standard deduction, then you can't reduce your tax by your gambling losses.

Don't worry about knowing tax rules, with TurboTax Live, you can connect with a real CPA or EA online from the comfort of your own home for unlimited tax advice and a line-by-line review, backed by a 100% accurate expert approved guarantee.

Keeping track of your winnings and losses

The IRS requires you to keep a log of your winnings and losses as a prerequisite to deducting losses from your winnings. This includes:

Popular Searches

- lotteries

- raffles

- horse and dog races

- casino games

- poker games

- and sports betting

Your records must include:

- the date and type of gambling you engage in

- the name and address of the places where you gamble

- the people you gambled with

- and the amount you win and lose

Other documentation to prove your losses can include:

Claiming Gambling Losses On Tax Return

- Form 5754

- wagering tickets

- canceled checks or credit records

- and receipts from the gambling facility

Limitations on loss deductions

The amount of gambling losses you can deduct can never exceed the winnings you report as income. For example, if you have $5,000 in winnings but $8,000 in losses, your deduction is limited to $5,000. You could not write off the remaining $3,000, or carry it forward to future years.

Claiming Gambling Losses On Tax Return Due Date

Reporting gambling losses

To report your gambling losses, you must itemize your income tax deductions on Schedule A. You would typically itemize deductions if your gambling losses plus all other itemized expenses are greater than the standard deduction for your filing status. If you claim the standard deduction,

Del Lago Resort & Casino, Waterloo: Hours, Address, del Lago Resort & Casino Reviews: 3.5/5. 1133 State Route 414 Exit 41 New York State Thruway, Waterloo, NY. Seize The Action. Take a break from the ordinary and experience nonstop action at del Lago Resort & Casino. Our modern gaming floor features over 1,700 Slots, 66 Table Games including 14 Poker Tables, and our all-new DraftKings Sportsbook with 23 betting kiosks available 24/7 and over 1,000 square feet of cutting-edge LED video screens. Casino resort waterloo new york in.

- You are still obligated to report and pay tax on all winnings you earn during the year.

- You will not be able to deduct any of your losses.

Only gambling losses

The IRS does not permit you to simply subtract your losses from your winnings and report your net profit or loss. And if you have a particularly unlucky year, you cannot just deduct your losses without reporting any winnings. If the IRS allowed this, then it's essentially subsidizing taxpayer gambling.

The bottom line is that losing money at a casino or the racetrack does not by itself reduce your tax bill. You need to first owe tax on winnings before a loss deduction is available. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

This article was originally published by TheStreet.